What is a W-4 Form?

Being an employee, it is very important to keep the government updated about your income and lifestyle. While updating your current employment status and other assorted details, certain taxes are levied according to the specified conditions. Federal income tax is one example of such taxes, which must be clarified to avoid any unfortunate cuts.

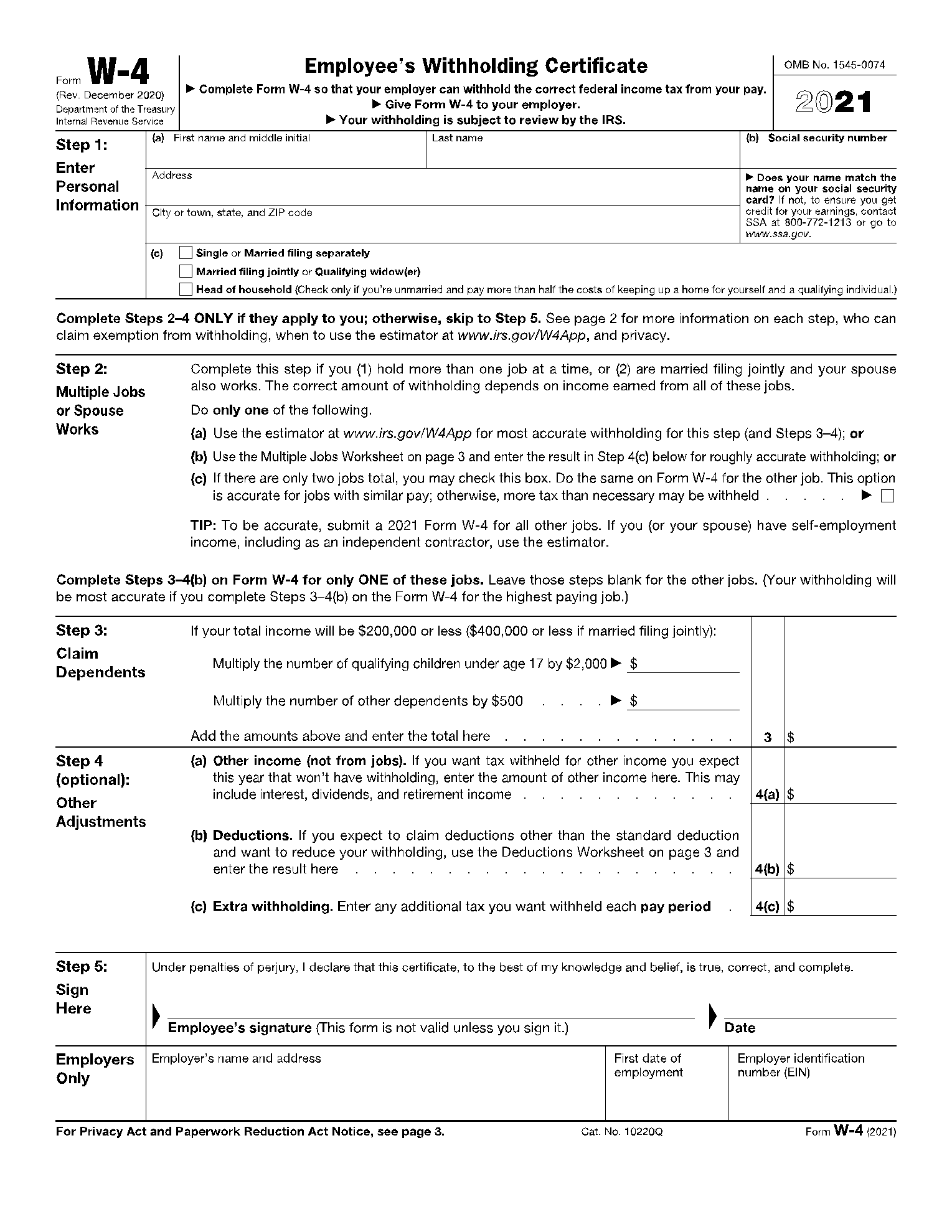

To ensure that the employer withholds the correct amount of federal income tax from a salary, it is important to have a correctly filled W-4 2020 PDF form. This version of the form helps employees provide all significant details about their jobs, which then helps settle an appropriate slab.

Information Required on a W-4 Form

A W-4 form is quite comprehensive in taking specific details from employees about their job statuses. To ensure there are no dishonest or extra taxes applied on any individual, the form is quite vocal about taking certain details about family members. When filling a W-4 form, the applicant needs to be aware of several details that they have to fill in at all costs. The details associating a W-4 form are provided as follows:

- Name, official residential address of the employee.

- Social Security Number

- Marital Status or House Position

- If the employee does multiple jobs, they need to fill out the Multiple Jobs Worksheet or check the box if they are paid a similar pay across the other job. The same holds relevant for conditions where the spouse works.

- Claiming any dependents if the income is less than $200,000.

- Mentioning other adjustments within the form if there are incomes from apart the job. Extra deductions and withholdings can be mentioned across the form.

- Signature of the Employee and the Employer.

How to Fill out a W-4 Form?

The steps that are required to fill a W-4 2020 PDF form are quite simple and effective. As this form involves setting up the tax system for an employee, its information needs to be accurate. However, to cater to this, the form needs to be filled out to perfection. Any applicant who is looking forward to filling a W-4 form should follow the steps described as follows:

Step 1: Fill out the name, address, SSN, and location details across Step 1 of this form. Provide the marital status or household position by checking any of the boxes across the form.

Step 2: The next few steps of the form are optional and are only applicable if the applicant fulfills any of them or not. In Step 2 of the W-4 form, the applicant needs to clarify the situation of multiple jobs or household jobs. The form allows the user to use an estimator for accurate withholding, use the Multiple Jobs Worksheet to provide details. In contrast, they can check a box if they are being paid a similar amount as in this job. These conditions apply under the state if the applicant's spouse is working.

Step 3: Claim any dependents if the total income is less than $200,000 or $400,000 if married.

Step 4: Provide any other sources of income apart from the job. Add in all the deductions claimed apart from withholding, and mention any extra withholdings from your current pay.

Step 5: The employee and the employer are required to sign the document to conclude filling it.

What is a W-4 Form Used For?

The purpose of filling in a W-4 Form is a very consistent one. Employers are required to submit these forms under every employee they hire for withholding the correct federal income tax from their pay. There are certain penalties associated with a wrong display of withholding tax. However, if someone is being charged more, they can file for a refund with this form.

The use of a W-4 form makes it consistent for employees to mention all changes in their personal and financial situation, over which they’d be charged a withholding tax.